South-south cooperation and the least developed countries

Report for the UN:

In recent decades international relations have become more multipolar, as seen in the increasing political and economic prominence of countries such as India and China, divergences between large developed countries and regions, and the continued emergence of the Global South. This is a trend long underway, but with renewed impetus via the spontaneous economic evolution of prominent countries in the South, Asia’s rapid recovery from the pandemic, and via intentional acts of solidarity among Southern countries. The ‘rise of the South’ is a process of reorientation of the world economy toward developing nations and their increased voice on the international stage.

South-South cooperation is a manifestation of solidarity among peoples and countries of the South that contributes to their national well-being, their national and collective self-reliance and the attainment of internationally agreed development goals like the 2030 Agenda for Sustainable Development. It involves technical and economic cooperation, norm-setting and economic interdependencies among developing countries with a view to mutual support.

This report is an attempt to review the role of South-South cooperation in the implementation of the Istanbul Programme of Action (IPoA) for the least developed countries, to take stock of best practices, and to scale up cooperation. The report focuses on the eight priority areas of action in the IPoA, shedding light on areas where South-South cooperation can play a catalytic role.

Concrete and actionable recommendations are made with the aim of helping LDCs to leverage and scale up South-South cooperation in the new Doha Programme of Action for the Least Developed Countries 2022-2031, in turn advancing progress towards the SDGs and achieving sustainable and transformative recovery from the pandemic.

Download the report here (PDF).

International support for the least developed countries: moving out of the mainstream

New short article on the Developing Economics site.

Next January In 2023, after being deferred due to Covid, the next United Nations Programme of Action for least developed countries (LDCs) will launch in Doha. It will set the framework for the next 10 years of international support for the world’s 46 officially poorest and most structurally disadvantaged countries, home to around a billion people.

LDCs are low-income countries confronting severe structural impediments to sustainable development. Membership of the category is based on three criteria: income per capita, human assets and economic and environmental vulnerability.

Assistance for LDCs currently falls under three categories: trade, aid and a range of ad hoc measures broadly aimed at help with taking part in the international system, such as lower contributions to the UN budget and support for travel to international meetings like the annual UN General Assembly.

Support is largely based on the premise that LDCs are artificially or temporarily excluded from global commerce. Preferential market access, temporary development assistance and help with participating in multilateral processes are intended to tackle this defect, in turn helping the LDCs ‘catch up’.

Dating to 1971, the category is the only one recognised in UN and multilateral legal texts. There is no official ‘developing country’ or ‘middle income’ category with associated support measures. Low income countries are not specifically targeted, and the small and vulnerable states are only recognised as a working group at the World Trade Organisation. They are not acknowledged in the legal texts.

Although donors don’t meet aid pledges and support doesn’t go far enough, official targets are possible because the LDC group is officially recognised in the UN system and has legal bearing. An example of such a target is the commitment by developed countries to deliver 0.15-0.20% of gross national income (GNI) in development assistance to LDCs. The European Union offers duty-free, quota-free market access to LDC exports under its Everything But Arms (EBA) trade scheme for LDCs.

The theory behind support for LDCs is implicitly based on the mainstream economics view that LDCs lag behind because they aren’t exposed enough to correct market prices and conditions. The removal of so-called distortions like overseas tariff and non-tariff barriers, alongside temporary development assistance and help taking part in the global system, is supposed to free up these economies to play a fuller role in the international economy. Economic growth will drive development and reduce poverty.

The evidence shows that for most LDCs this theory never worked. Until the pandemic the economies of some LDCs were performing well. Up to 12 could leave the category in coming years. A few, like Bangladesh, Cambodia and Myanmar, were able to take advantage of lower tariffs for their garment exports. These three countries account for 87% of imports to the EU under EBA.

But half were supposed to meet the criteria by 2020, according to international targets. 12 graduations falls well short. The six that have left since the formation of the category in 1971 have not all done so because of better international market access or special support measures. Commodity exports, tourism or improved health and education are mostly responsible.

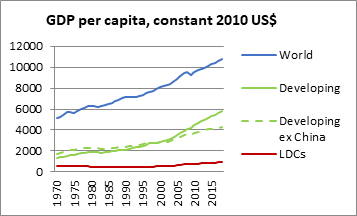

The remaining LDCs aren’t catching up. The gap is widening. The pandemic devastated the group. Gross domestic product (GDP) shrank 1.3% on average in 2020, with the economies of 37 contracting during the year and extreme poverty in the group rising by a staggering 84 million. But even before Covid, average real GDP per capita for the group had long diverged from other developing countries and the rest of the world.

Source: UNCTAD Stat: https://unctadstat.unctad.org

Pushed behind

In over a third of LDCs real gross national income per capita has fallen since 2015, according to UN estimates. The vulnerability scores of 19 LDCs (over two-fifths of the total) deteriorated over the same period.

Trade performance has also missed targets, a telling failure given that most international support is for trade. For the majority of LDCs, better market access hasn’t spurred integration. Not many countries fully use the trade preferences available to them. African countries account for less than 5% of total Generalised System of Preference imports to the EU.

LDC imports have grown considerably faster than exports in the last decade, and LDCs’ collective share of global merchandise exports – a key international metric – is no higher than a decade earlier, at less than one percent. Trade per capita remains very low – under a tenth of the world average. According to the UN conference on Trade and Development (UNCTAD) 85% of LDCs remain dependent on commodity exports.

However well-designed trade preference schemes are, they will fail to address the fundamental economic problems facing most LDCs – particularly in Africa. These challenges include deindustrialisation, stagnation and reverse transformation characterised by a premature shift of the labour force into services, often informal. For many of the region’s LDCs, commodity dependence and a lack of value-addition mostly remain just as bad as they were decades ago.

Conventional structural transformation into higher value-adding activities, driven by a move from agriculture into manufacturing, isn’t occurring, with a corresponding drag on productivity. Unemployment and semi- or informal employment remain extremely high and are even worsening. The creation of decent jobs for burgeoning young populations via revamped production is the pressing task facing the majority of LDCs that are being left behind.

Even under conditions of full inward and outward openness to international investment and trade – ie. the conditions which the implicit theory underlying the current composition of international support posits as optimal – sustainable economic development may not take place. With current international support, countries on the global periphery will always struggle to develop in a way that meets human and ecological needs, unless active measures are taken to overcome these problems.

These shortcomings raise questions about the existing approach to international support. Before Doha they imply the need to re-examine the underlying assumptions and theory behind existing support – and to propose a new framework.

Barking up the wrong baobab: some alternative proposals for support

International trade preference schemes are important for some countries – and the idea is not to criticise market access. But as a broad solution to the deep-seated problems of the LDCs that are being left behind, they amount to barking up the wrong baobab. Most LDCs just don’t produce enough goods or services and aren’t ‘flexible’ enough to respond to what are imagined to be ‘correct’ international prices. Whatever we’ve been doing so far, it isn’t good enough.

This requires a long, hard, stare at the existing theory. Given the shortcomings of this mainstream approach, it’s time to revisit alternatives, particularly the developmentalist and structuralist traditions aimed exactly at the challenges now faced by the marginalised LDCs.1 These perspectives need to be revived and revitalised to acknowledge ecological imperatives, and reflected in international support for LDCs.

Broadly, these schools of thought emphasise not market access but active global regulation of commodity flows; government intervention to build productive capacity (for the domestic market as well as foreign); and the direct promotion of structural transformation using a range of support options tailored to individual country circumstance.

‘Flexibility’ isn’t necessarily either desirable or possible. If it means lower worker protections, weaker environmental standards or anti-union laws, it is by definition contrary to the goal of societal and ecological resilience. It also risks worsening already worrying trends in inequality. Flexibility can also lower economic growth by weakening aggregate demand as job insecurity, unemployment or semi-employment and downward wage pressures reduce consumer spending. Rather, we should be aiming to build demand and resilience.

One of the most crucial tasks is to raise the rate of sustainable investment, via public revenues and investment in the capital stock. In LDCs the absolute and per capita rates of domestic savings and investment are consistently lower than other developing countries, a shortfall which acts as a particular drag on the development of productive capacities.

As Kaldor said: “It is shortage of resources, and not inadequate incentives, which limits the pace of economic development. Indeed the importance of public revenue from the point of view of accelerated economic development could hardly be exaggerated.”2

There is a need for systemic improvement to the multilateral architecture relating to LDCs – driven by LDC governments themselves and differentiated according to context. Acknowledging these ideas, in a recent paper I propose six areas of support, relating to the UN system, finance, trade, commodities, technology, and the environment and climate change.

Productive capacity should be the main overarching theme, with concrete, actionable and time-bound activities. A new sustainable productive capacity fund, for example, could act as the lynchpin of the new architecture, with financing for sub-components of productive capacity including technology transfer, entrepreneurship, linkages development and human and physical capital accumulation. Industrial policy is essential – and in this regard trade and donor countries should allow policy space.

In the paper each of six themes is accompanied by specific, practical proposals – 30 in total – which might be considered in the next programme of action. For instance the IMF and World Bank don’t use the LDC category, which means that their lending and other interventions aren’t coordinated with those of the UN. Even bilaterals and parts of the UN system often only pay lip-service. They should be encouraged to recognise the category fully.

Given that capital accumulation is so central to productive capacity, a big push on financing is needed. Official donors need to fulfil their aid commitments to LDCs, devoting more of it to transforming production. As highlighted by Kaldor, more emphasis needs to be placed on helping governments build domestic revenues. The Debt Service Suspension Initiative (DSSI) is welcome but should be made permanent and should consider write-offs, not only suspension of payments. It should also monitor international lending and warn of potential excesses, with a focus not only on recipients but on lenders.

That commodity dependence remains the bane of many African LDCs is not for want of ideas. Innovative proposals exist for price stabilisation schemes; counter-cyclical loan and financing facilities; taxing commodity derivatives markets; and making companies pay for the damage caused by resource extraction. The time has come to put these ideas into practice.

Technology and intellectual property are critical. World Trade Organisation members should be held to account in their unfulfilled obligations to conduct technology transfer to LDCs. The US-backed TRIPS vaccine waiver needs to be operationalised as soon as possible so as to allow the several LDC pharmaceutical manufacturers that exist (and other developing countries) to produce the Covid vaccine. The Technology Bank for LDCs founded in Turkey three years ago must be funded properly.

Climate financing needs to increase and be made more accessible – many capacity-constrained LDCs report finding it difficult to jump the administrative hurdles of the Green Climate Fund or the LDC Fund. Donors also need to be held to account in their aid promises, particularly after the LDC Fund ran out. Financing should also be linked to trade and orientated toward sustainable infrastructure built to resist climate breakdown. LDCs didn’t cause the climate catastrophe. They can ill-afford its consequences.

I can’t count the number of LDC government officials or ministers who’ve told me they spent years following international advice, only for it to fail. First, under the Washington Consensus and its variants they opened up domestic markets, privatised state companies and cut fiscal spending – often with disastrous results. Then they were told that their newly supple economies would spring into action as liberal international market access opened up new opportunities. This too, mostly didn’t happen.

In order to avoid yet more disappointment – not to mention the unthinkable immiseration manifested in the grinding poverty and exclusion experienced by the global periphery – it’s imperative that the underpinnings of international support are rethought and updated. Because of its multilateral recognition, the LDC category is a ready tool which can rapidly be deployed to practical effect.

This isn’t to say that some trade support hasn’t been helpful, or to cast a slur on the good intentions of some international actors; it’s to recognise that much more needs to be done in order to avoid a decade of inaction. It would be a travesty to dither while a billion people languish. The best practical ideas often spring from quality theory. The mainstream failed. It’s time to move forward.

Working paper: Daniel Gay (2021) A critical reflection on international support for least developed countries

Services growth in the least developed countries

Published on the UN International Support Measures Portal for Least Developed Countries.

In Maseru, the capital of Lesotho, a roadside stall sells drinks, fruit and mobile phone top-up cards. Half a dozen pairs of trousers hang from a peg above a row of shoes. Passers-by pause briefly to buy what they need.

Enterprises like these small kiosks are at the core of the economy, the silent nucleus around which life revolves. Ranging from shoe-shine to taxis, supermarkets to food-sellers, Lesotho’s tertiary sector has grown to 55% of gross domestic product, according to UN data, employing 42% of the workforce.

The story is typical. In the least developed countries (LDCs), formal and informal services are expanding fast, accounting for nearly half of output and a third of employment as shown by the latest figures.[1]

Although services are increasingly important worldwide — and a sign of entrepreneurship — this trend isn’t necessarily a good thing. Services productivity tends to be lower than manufacturing because intangibles can’t easily be traded and tend to have lower returns to scale.

LDCs also feature lower services productivity than in many other countries. Companies tend to be smaller, less efficient and far from the technological cutting-edge. A market stallholder generates much less output than a software company employee.

In many LDCs, particularly in Africa, people are increasingly leaving behind traditional low-paid or subsistence rural work. But manufacturing isn’t growing fast enough – or even at all – to take up the slack. ‘Premature deindustrialisation’ means that unlike in the traditional idea of development, a move out of the fields isn’t a guaranteed route to the production line.

Instead, many people pick up semi-formal or informal services work in or near the city. In Maseru the garment sector isn’t big enough to accommodate all those looking for employment; hence the proliferation of roadside kiosks.

Even in countries where manufacturing is growing, it mostly isn’t doing so fast enough to offset the expansion of the low-productivity tertiary sector where most jobs are created. The task of development involves not just the shift away from agriculture, as conventionally understood, but narrowing this gulf between manufacturing and services.

You can’t export a taxi ride

Not only are many LDC services companies small and create little value – often reselling finished goods — they usually don’t export. You can’t sell a taxi ride overseas. Phone cards are only for domestic use. This lack of tradeability further limits productivity growth.

Sales of LDC services abroad have risen over the past decade but only to less than half a percent of the world total. A handful of countries dominate, alongside a few sectors – mostly tourism, transport and distribution. Knowledge and tech-intensive services hardly feature. Linkages with the rest of the economy are minimal.

In a sensible attempt to boost LDC services export growth, a decade ago World Trade Organisation (WTO) member countries agreed the so-called ‘services waiver,’ which allows WTO members to grant preferential treatment to services and service suppliers from LDCs.

This is the main source of international support for services in LDCs. It was supposed to better integrate these countries into services trade. But despite some progress, not much has changed.

LDCs just can’t produce enough to meet international services demand – emphasising the need to build productive capacity, broadly defined. Other obstacles include a lack of visas and work permits; fees, charges and taxes; as well as insufficient funds or representatives to sell things in destination markets.[2]

But a wider issue is that the services sector is simply such a large category that it effectively acts as a ‘catch-all’ for anything that doesn’t count as agriculture or manufacturing. In that sense it’s quite badly-named.

An increasing amount of economic activity takes place in the grey area where intangible activity overlaps with manufacturing or farming. Many manufacturers now ‘servitize’ production, charging for a product based on the number of hours it is used instead of selling it wholesale, or adding a range of services beyond production such as location tracking or preventative maintenance. Most modern producers now use services in production, and a large number of employees engage in services activities.

Some things are just difficult to define. A mobile telephone sold with a subscription could be seen as both a product with a service and a service with a product.

Consider 3D-printing or additive manufacturing, whereby polymers are used to ‘print’ a variety of finished items. It isn’t pure manufacturing since most of the know-how comes via software, often traded online. It isn’t a pure service since the output is a physical object.

It’s therefore hard to isolate and discriminate purely in favour of an LDC – or any – ‘service’ export. Integrating LDCs into services trade may be important, but it’s only part of the challenge facing the sector.

The services waiver is well-intentioned and part of the solution, but the difficult conclusion is that because the line between different types of economic activity is increasingly fuzzy, the vital task of boosting productivity in LDCs means considering the economy as a whole, which implies modernising production and adopting new technologies, both secondary and tertiary. Targeting either manufacturing or services alone is no longer straightforward.

Simply allowing WTO members the freedom to prioritise LDC exports isn’t enough. Not all members will do so consistently. Supply constraints affect LDCs’ ability to benefit. More direct and concrete measures are needed to address the structural challenges of low incomes, vulnerability and limited education and skills. Services must be prioritised not just as exports in themselves, but also as lubricant in the machinery of production – as an indispensable part of contemporary economies.

In this sense a full range of support is needed, including more detailed, specific and practical measures to support LDC exports; broader geographical coverage; a renewed push to build productive capacity, and collaboration among LDCs themselves.

And the age-old yet always pressing challenges remain: technology transfer, entrepreneurship and human and physical capital accumulation in an attempt to narrow the dualisms within developing economies. Plus ça change, plus c’est la même chose.

[1] Source: UNCTAD Least Developed Countries Report 2020, https://unctad.org/system/files/official-document/ldcr2020_en.pdf

[2] UNCTAD (2020) ‘Effective Market Access for Least Developed Countries’ services exports: An Analysis of the World Trade Organization Services Waiver for Least Developed Countries,’ https://unctad.org/system/files/official-document/ditctncd2019d1_en.pdf

This article has been made possible with financial support from the UN Peace and Development Fund.

The need directly to target sustainable productive capacity in least developed countries

Published on the UN International Support measures Portal for Least Developed Countries.

Covid-19 uncovered an uncomfortable truth. International support for least developed countries (LDCs), though welcome and contributing to some success, hasn’t done as was hoped to build economies over the long run or to mitigate crises.

The pandemic hit trade, tourism, debt, remittances and foreign direct investment in LDCs at least as badly as other countries. Gross domestic product for the group shrank an expected 1.3 per cent in 2020, according to the UN’s comprehensive study on the impact of Covid-19 on the LDC category. Of 46 LDCs for which data are available, the economies of 37 contracted during the year – and the impact of the crisis will play out for many years.

Governments were too short of funds to support their populations during the downturn. Furlough was impossible for cash-strapped Ministries of Finance. Most LDCs don’t have any social insurance.

Unlike in many middle-income or developed countries, a lack of Internet access and the absence of digital economies meant that most people in LDCs couldn’t work remotely. The economies of many LDCs sputtered to a halt as workers were forced to stay at home.

The human cost was enormous. Thirty-two million people in LDCs fell back into extreme poverty in 2020.

To help address the downturn, donors delivered 1.8% more official development assistance (ODA) to LDCs in 2020, sending the total to US$ 34 billion. But this was below official pledges – and nowhere near enough to cushion the impact of Covid.

Alongside ODA the main long-term source of international help has been duty-free, quota-free market access to developed and some other countries. In theory it gives exporters a competitive edge.[1]

The absence of caps or taxes on LDC exports particularly benefited Bangladesh, Cambodia and Myanmar, which by 2020 together accounted for 87.3 per cent of imports to the European Union under its Everything But Arms scheme launched nearly two decades earlier.[2]

This select trio of Asian LDCs have successfully used the scheme to raise exports because they possess the production capabilities to take advantage. Dynamic garment producers, exploiting mass cheap labour, leveraged trade concessions to increase output.

Health and education improved dramatically alongside investment and domestic linkages. Several graduating Asian LDCs have been able to piggy-back on their neighbours’ rise.

African countries, however, make up less than five per cent of total Generalised System of Preference imports to Europe. Most African economies don’t make enough of the right products to use preferences, and they struggle to meet the required rules and standards. Trade is also more difficult in a less prosperous or connected continent.

As crisis hit, most LDCs were too fragile to cope as international demand dried up. Even in countries like Bangladesh which made successful use of trade schemes, orders dwindled as Europeans stopped shopping. In tourism destinations, visitors no longer arrived. Commodity demand dropped.

Contrary to the assumptions of the trade models used to justify trade preferences, the economies of most LDCs just aren’t flexible enough to respond quickly to changes in international prices that result from lower taxes – nor will they be for a long time, if ever.

Workers and capital don’t quickly move to where they are most needed. Many countries remain dependent on a narrow range of commodities or products to which little value is added. This is why trade preferences are only a partial solution and don’t help all economies.

The evidence: the Covid crisis capped a period during which the economies of most LDCs fell further behind the rest of the world, despite a few bright spots such as the dozen countries that have been identified for graduation or look likely to graduate from the category during the 2020s.

Data source: UNCTAD Stat

Hitting reset

This was supposed to be the era in which the gap narrowed. International support in the form of aid, trade preferences and other benefits were meant to form a coherent package of support which catapulted LDCs onto the same trajectory as other developing nations.

But most LDCs have not prospered as expected. The UN Conference on Trade and Development Productive Capacities Index shows that productive capacity in LDCs has only risen about 20% in the past two decades – no faster than the world average. The gap remains.

During the repeated global convulsions of recent decades, many LDCs found themselves over-reliant on international demand in a narrow range of products and services, with limited domestic activity as a back-up – let alone a modern, digital economy. Worse, some LDCs were both internationally disconnected and domestically fragile.

It may be time directly to start targeting the economic engine in LDCs rather than hoping that exposure to overseas markets will automatically spur development and resilience. Given the severity of the situation and the shortcomings of the approach so far, all options should be considered.

A concerted push to boost national production is needed from governments, donor partners and the international system. Donors could, for example, establish an endowment for productive capacity. The fund could raise financing for finance climate-resilient green infrastructure and energy, crowding in private investment and technology transfer to establish the basic building blocks of economic development such as railways, bridges, schools and housing.

Whether this can occur via existing mechanisms like the under-capitalised LDC Climate Fund, or if a dedicated facility is needed, there is little doubt that coordinated action is needed. Diagnostics such as the Organisation for Economic Cooperation and Development Production Transformation Policy Reviews or the Enhanced Integrated Framework are a good place to start when deciding where funds should go.

At only around a fifth of GDP, investment rates in LDCs are mostly too low to spark economic transformation. Governments need to accumulate more domestic resources. Tax revenues in LDCs remain too low to support national investment or to insure populations against crises.

The crisis could even be seized as an opportunity to spark sustainable transformation. As noted by Harvard’s Ricardo Hausmann, developing countries may be able to carve out opportunities in a rapidly greening world. Countries can also the target value chains that underpin the new development paths – including inputs, capital goods, engineering and procurement. Health, pharmaceuticals and medical goods production should be a part of fostering resilience.

Infrastructure and energy fell out of fashion in recent decades as donors worried about corruption, white elephants and sustainability. But power and construction are coming back into vogue. China’s Belt and Road initiative has been supporting priorities including connectivity and infrastructure. The G7 at its latest summit in June 2021 pledged a multibillion dollar ‘Build Back Better for the World’ initiative for green infrastructure in developing countries.

A broad-based push toward green productive capacity would be to the advantage of the whole world as would discourage emerging countries from moving toward carbon-heavy energies like coal.

LDCs also need to embark on digitisation strategies, building up the capabilities to take advantage of the fourth industrial revolution, itself environmentally more sustainable as it relies less on physical transport. Regional trade and cooperation are easier online than in physical products, especially in poorly-connected countries.

This drive for green and digital investment, and an improvement in LDCs’ ability to make things for themselves, will both bolster domestic economic activity and leave countries less exposed to the seemingly ceaseless shakes coming from the world economy.

This is not to discount the importance of exports nor to advocate isolation. It is to recognise that exports are increasingly digital, and that they won’t emerge spontaneously in response to world demand. Before you export, you must produce.

The pandemic again confirmed how important it is to build the economic engine. No country is resilient until all are resilient.

The views in this article are those of the author and do not necessarily represent the views of CDP, its Secretariat, or the United Nations. This document should not be considered as the official position of the CDP, its Secretariat or the United Nations. Any remaining faults are those of the author.

This article has been made possible with financial support from the UN Peace and Development Fund.

[1] Several donors and multilateral organisations have also long provided various types of technical assistance, travel grants and other support to LDCs.

[2] European Commission (2020) ‘Joint Report to the European Parliament and the Council on the Generalised Scheme of Preferences Covering the Period 2018-2019’. High Representative of the Union for Foreign Affairs And Security Policy, Brussels, 10 February.

Productive capacity as resilience

Published on the UN least developed countries Portal.

Least developed countries (LDCs) were hit harder than most by a succession of crises in recent years – from the Asian crisis to the dotcom collapse, SARS and bird ‘flu, then the global economic crisis, several climate-related disasters and finally Covid-19. For the nearly 400 million extremely poor people in LDCs, the health, financial and social impact of these shocks were catastrophic. On the breadline, any loss of income is disastrous. LDC governments have fewer resources to cushion the impact. Policymakers are increasingly asking how to deal with this seemingly endless catalogue of calamities. Resilience is the new watchword.

Resilience is sometimes defined as the opposite of vulnerability, or the ability of an economy to withstand or recover from shocks.[1] Economies are supposed to be resilient if they can overcome a crisis and recover, perhaps supported by aid, low debt and fiscal tightening in order to satisfy international lenders, together with labour-market flexibility. Policies should help economies quickly recover their original shape, minimising time in the downturn and resuming their equilibrium path.

But maybe this is the wrong way to think about robustness? After all, most economies are vulnerable. During the past two decades 103 countries—over half the world’s total—at one point had a vulnerability rating too high to pass the LDC graduation threshold. Developing countries on average now have a vulnerability score of 33.6, which would mean they would be too vulnerable to qualify for LDC graduation based on the threshold of 32 or below.[2]

If developing countries in general–never mind LDCs—don’t meet the vulnerability criteria, it implies that the most sensible policy might not be to try to avoid vulnerability using standard tools. Vulnerability seems an inevitable feature of today’s world economy. Considerable time and resources, for example, may be wasted on trying to meet the expectations of international creditors, with little benefit for resilience. The optimal route to robustness may be to form the ability to recover from shocks and re-emerge in a different form.

Resilience is not linear, or only about the ability of an economy to regain its old shape.[3] If this were the case it would be difficult to reconcile the notion with the idea of economic evolution. The more resilient an economy was, the less it would change over time, even in the face of shocks. An economy whose structure doesn’t change can’t be considered resilient on any reasonable understanding.

A more helpful definition may be one in which an economy can adapt to the increasing likelihood of crises and recover – but crucially to a more dynamic, advanced state than before – and without any specific predictions about the future production landscape. This definition fits with the broad notion of building back better, although it can also be thought of as ‘bouncing forward’.[4]

Resilience should be an ongoing process rather than a recovery to a pre-existing or new stable equilibrium. This shifts the debate away from how an economy resists change to how it adapts through time to various kinds of stress. Resilient economies and supply chains emerge from shocks as different entities rather than snapping back like a piece of elastic to some pre-crisis state. This approach is about frequent change rather than hoping for stability and having to try and compensate for unpredictable downturns.

Resilience as transformation

The countries that rebounded fastest from the pandemic—including several in East Asia—were mostly those with the strongest productive capacity, adaptability and technological sophistication. These countries were able to produce and export the goods that were in high demand during the crisis, like electronics and pharmaceuticals, to attract foreign direct investment (FDI) and move into new, high-technology areas. Their resilience lies in their ability to transform the economic structure.

Chinese FDI inflows actually increased in 2020, by 4%, compared with a slump of 69% to developed economies.[5] As a result China overtook the United States as the world’s largest recipient of FDI. Asia accounted for more than half of global cross-border investment in the same year.

Of course, these are big economies that locked down early, rolled out the vaccine quickly and put in place strong health and fiscal responses. Lessons for LDCs are limited. But the East Asian states that rebounded so quickly are at the forefront of technological advance and have long been the exemplars of structural transformation—often reshaping the domestic economy with unconventional policies.

Development took place during times of frequent crisis. Powerful industrial structures emerged which could respond to, and generate, new demand. At times government expenditure and debt were high as the country invested in structural transformation and pursued expansionary fiscal policy. Job creation was rapid, which supported demand and brought large numbers of people out of poverty.

It is sometimes forgotten just how far-reaching was the transformation and how rocky the journey. In 1964 the Republic of Korea was poorer per head than the Congo. In effect it was an LDC, although the category did not yet exist. Hundreds of millions of Chinese people moved out of extreme rural poverty in the last few decades. Viet Nam’s rise was later but no less remarkable. Resilience, for the most dynamic East Asian countries, had little to do with rebuilding back to a pre-crisis state. Development meant a societal and economic overhaul, often as a process of adaptation in response to shocks.

The implications for LDCs are clear. Recovery from the pandemic is of course the immediate priority, and this should mean equal access to vaccines, international support and a strong economic stimulus where possible—together with a resumption of demand in the developed world. Better international support is critical.

But aid can only play a partial role in rescuing LDCs from the pandemic and protecting them from future instability. Often, governments may need to deviate from the standard prescriptions—perhaps allowing the temporary build-up of debt during crises, spending more and limiting lay-offs. This can allow them to build climate-resilient infrastructure, maintain demand and help workers keep their jobs in a downturn – the ultimate form of resilience.

In the longer term, the most anti-fragile response would be to try to ‘bounce forward,’ changing the economic structure for the better. This will involve policy space to redouble the long-term effort to build productive capacity, defined by the UN Conference on Trade and Development (UNCTAD) and the UN Committee for Development Policy (CDP) as the sustainable development of human and physical resources, entrepreneurship and linkages.

Productive capacity-building needs to take into account the likelihood of crises and expanding the economy so that it can withstand disruptions. Capital accumulation and technological progress are central to this process, alongside sustainable trade and investment.

Governments should try to diagnose the major obstacles to transformation, be it insufficient resources or investment, skills shortages, get-up-and-go among businesspeople, or connections up and down the supply chain. Everything should be done to tackle the binding constraints head-on.

Covid-19 won’t be the last major shock. The best way for LDCs to prepare for the next crisis is to keep building the economic engine and to bounce forward, not back.

[1] Eg. Briguglio, L. G. Cordina, N. Farrugia and S. Vella (2008) ‘Economic Vulnerability and Resilience,’ UNU-WIDER research paper no. 2008/55, May 2008

[2] Data source: https://www.un.org/development/desa/dpad/least-developed-country-category/ldc-data-retrieval.html

[3] Eg. Nelson, R. and S. Winter (1982) An Evolutionary Theory of Economic Change, Cambridge (MA), The Belknap Press of Harvard University Press, 1982; Simmie, J. and R. Martin (2010) ‘The economic resilience of regions: towards an evolutionary approach,’ Cambridge Journal of Regions, Economy and Society, Volume 3, Issue 1, March 2010, Pages 27–43, https://doi.org/10.1093/cjres/rsp029

[4] ‘Bouncing forward: a resilience approach to dealing with COVID-19 and future systemic shocks,’ https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7247742/

[5] Source: UNCTAD: ‘Global foreign direct investment fell by 42% in 2020, outlook remains weak,’ https://unctad.org/fr/node/31924

As part of the European Green Deal the European Union (EU) is establishing a carbon border adjustment mechanism (CBAM), which will put a carbon price on imports of certain goods from outside the EU. The mechanism is designed to disincentivise European companies from producing their products elsewhere – known as carbon ‘leakage’ – and to prevent European producers from being undercut by cheaper, high-carbon imports. Least developed countries (LDCs) should be exempt from the CBAM and benefit from revenues generated by the mechanism. This article, for the United Nations LDC Portal on International Support Measures for LDCs, explains more.

Click here to read the piece.

Shaky progress: structural transformation in graduating Pacific least developed countries

I’ve just published a new UN working paper on the Pacific’s least developed countries (LDCs). The paper finds that whilst these economies have been growing reasonably quickly, bringing them to the point where they’re eligible to leave the LDC category, their structures aren’t changing fast enough or in the right ways to spark widespread transformation.

The countries in question — Kiribati, Solomon Islands, Tuvalu and Vanuatu* — aren’t industrialising. This might not sound surprising, but the paper shows so clearly, with international data stretching back two decades. The finding has far-reaching implications for the region and similar countries.

In theory, developing economies are supposed to move from low-productivity activities like agriculture to high productivity pursuits such as manufacturing. Factories are important because they build mass employment for subsistence or agricultural workers and increase value-addition. In turn this raises living standards and creates the wealth needed for investment in health and education.

This hasn’t been happening in the Pacific (or in many other LDCs, for that matter). Economic output has shifted away from agriculture over the past 20 years, but mostly toward services. Almost all new jobs created have been in retail and tourism — progress, but shaky.

As we’ve seen in the Covid-19 crisis, tourism is vulnerable to global instability. The industry almost completely screeched to a halt in 2020. Last year’s 74% collapse in global visitor numbers was the biggest ever, according to the World Tourism Organisation. For a country like Vanuatu, the LDC most dependent on tourism, this was devastating, removing the main source of foreign exchange, investment and secondary economic activity.

Most simple services like tourism and shopping are inherently less productive. A tour group, for example, can only reach a certain size – maybe 20-30 people per guide – before it becomes unviable. A shop can only employ so many assistants, and pay is limited. The gains from mechanisation can, in contrast, be extremely high as marginal costs fall.

Not only are the Pacific LDCs failing to industrialise or to raise productivity, but trade liberalization hasn’t produced the desired results either. This runs counter to the mainstream theory, which says that exposing the economy to international competition should encourage entrepreneurs or existing companies to move into areas in which the country has a comparative advantage, in turn improving productivity.

In the Pacific, trade hasn’t grown much relative to the size of the economy. Exports in three of the four regional LDCs have become less diversified since 1995.

It shouldn’t be too much of a shock that the traditional idea of structural transformation doesn’t apply in the Pacific LDCs. These countries are tiny, all falling within the world’s 15-smallest by population. Tuvalu has the smallest economy of any independent territory in the world. GDP is about the same size as the US city of Albequerque, or Edinburgh, Scotland’s capital city. If you added up the GDP of all four Pacific LDCs it’d still be smaller than that of the Central African Republic.

They’re enormous by sea area. Kiribati covers the 12th-largest sea area of any country, 3.4 million square kilometres — bigger than India’s total land and water area, and much bigger than the Caribbean Sea. Because the islands’ small populations are spread across such a wide area the workforce is mostly very fragmented, raising the cost of domestic transport and limiting economies of scale.

These countries are so spread out that their producer and consumer bases are miniscule. Isolation means that trade costs are extremely high, making import and export costly. No Pacific island capital is within 2,000 km of Sydney or Auckland.

Whilst it isn’t a big surprise that the standard theory proves inappropriate, it does raise the question as to why so much international advice and thinking runs along conventional lines. It doesn’t make sense to recommend normal routes to industrialisation, or to continue to spend so much of the region’s extremely scarce human resources on yet more trade negotiations.

Most of the economy in these countries isn’t market-based or commercial. Subsistence still plays a big role in Melanesia and beyond. Domestic economies will never be very flexible because of their peculiar characteristics, so policies that aim to alter incentives or free up markets will only have limited impact.

Dependence on government spending across the four countries is so high that on average it forms 80% of GDP . By comparison the LDC average is 11%. Transfers from abroad, donor aid and remittances are also historically huge. None of these things are affected by national policies aimed at stimulating markets or cutting the role of government.

There’s a need to think creatively about analysis and policies. New, context-sensitive ways of thinking about economic transformation must be conceptualized and enacted to promote the next phase of economic development.

The paper tries to start thinking a bit deeper about what this might mean in the very special circumstances of the Pacific. Part of the challenge lies in escaping the old ways, and not continuing to adopt models drawn from other contexts.

Firstly, governments and donors will remain a large part of the economy for many years to come — in many cases not just as a complement to the private sector or as a source of incentives, but as a source of service provision, resilience and ultimately a component of aggregate demand. Trying to shrink fiscal expenditure in the name of efficiency will often only weaken economic growth.

Secondly, linkages should form a much higher priority than they have done until now. The region could capitalise much more on what is termed the ‘blue economy‘ — leveraging the region’s huge ocean resources sustainably for tourism, fisheries and niche, high-value agriculture. Government and donors can play a role in stimulating production up and down individual value chains so that more money stays inside the country and local producers benefit from tourism.

Thirdly, institutional management should be rethought. Instead of spreading skilled officials across 10 conventional Westminster-style ministries, valued staff should be brought together in a single economic management unit. Some countries, like Singapore and Rwanda, have based their entire development strategy on economic development boards. Consolidation would lead to better coordination in areas like linkages policy.

Fourthly, the so-called fourth industrial revolution isn’t too advanced for the Pacific, and any hope for structural transformation should take into account modern technologies and the increased merging of manufacturing and services. Whilst many developing countries fear the loss of jobs to robots, this isn’t a concern for a region that never industrialised. At a stretch it’s possible to imagine the region leapfrogging some previous technologies.

Major opportunities exist in services with low start-up costs where physical location is less important and which serve the international market. Business process outsourcing and microwork may have potential. Tourism is now even possible online. In September 2020 Amazon launched a new service called Explore that allows customers to book live, virtual experiences led by local experts who conduct virtual tours.

New processes like additive manufacturing are almost made for the region. In principle 3D printers could make products using recyled raw materials, reducing the need to import things thousands of miles on expensive shipping routes.

Drone and surveillance technologies could benefit fisheries and the environment. For instance a New Zealand company is currently trialling an autonomous sea craft to police Pacific waters. The sea-based drone can detect illegal fishing, help with search and rescue by deploying life rafts; assess cyclone damage to remote islands by launching aerial drones; and collect scientific data, particularly on climate change.

Its energy comes from solar panels and a horizontal wind turbine, which power batteries that enable the craft to operate autonomously for long periods. Such technologies can address many of the challenges faced by island countries simultaneously, including illegal fishing, safety at sea, and climate change.

Technology is no panacea, and the fourth industrial revolution will not provide all the answers for structural transformation. Policies will remain critical. Governments will among other things need to keep tackling the uphill tasks of education and training; rules and regulations; lowering the cost of internet access and speeding it up; and making the living environment attractive enough to retain skilled workers and attract new investors.

Donor partners will need to keep investing in the region, and taking enough of a hands-off approach to allow policymakers to make mistakes and learn from them.

The paper is by no means exhaustive, and plenty more ideas along these lines are needed. Neither does it deny the progress that the likes of Vanuatu has made in tourism. But hopefully it shows that thinking a bit differently and seizing on new trends may yield dividends for the region — as well as small, marginalised countries elsewhere.

Download the paper here (pdf), from the UN Economic and Social Commission for Asia and the Pacific (UNESCAP) Macroeconomic Policy and Financing for Development (MPFD) Working Paper Series.

*Vanuatu graduated from the LDC category in December 2020.

The need to extend the WTO TRIPS pharmaceuticals transition period for least developed countries in the Covid-19 era: Evidence from Bangladesh

New UN policy brief (pdf) with Prof. Kevin Gallagher of Boston University.

Abstract

Bangladesh is one of the most successful least developed countries (LDCs). The country has made such strides that in 2021 the United Nations Committee for Development Policy will consider whether it should graduate out of the LDC category altogether. Like few others, Bangladesh took advantage of WTO flexibilities to build a vibrant pharmaceuticals industry that provides needed industrialization and employment. The pharmaceuticals industry also gives access to essential medicines to millions of Bangladeshis as well as people in other developing countries and LDCs. LDC graduation would bring a loss of WTO exceptions, particularly in intellectual property. This policy brief synthesizes recent research, showing that Bangladesh’s vital pharmaceutical industry would be threatened if the country had to adhere fully to WTO rules upon LDC graduation. Given that COVID-19 has dealt such a severe blow to Bangladesh’s development and health prospects, these papers point to the need for Bangladesh to be able to maintain its WTO flexibilities in order for the sector to remain a source of economic growth and health provision in the years to come.

Building the world back realistically

My last post on the need to build the world back better said that most discussion of the post-covid recovery is mistakenly confined to national borders and should have a global dimension.

It’s a view that could be read as idealistic and naive. The world is retreating from physical globalisation. Building the world back better is probably far from most people’s minds.

The G20 can’t even coordinate itself as it did during the last crisis. The world’s multilateral institutions are under attack: the World Trade Organisation and the World Health Organisation, and more broadly the United Nations. Europeans squabble. The United States and China are Punch and Judy.

But even if world leaders look like they’re intent on turning back the clock rather than building back better, it’s at least worth saying something. As I said in the conclusion to my post, sometimes things change quickly.

For progressives or internationalists it’s also important to think about how and why change happens. The cynic who imagines everything always gets worse is just as inaccurate as the relentless optimist. We’re not heading for an entirely splintered, uncoordinated world where all countries shut in on themselves.

Progress occurs, but it has to be fought for. Who’d have thought a couple of months ago that US protests against police discrimination and violence could have shut down a police department and spread worldwide? Certainly not me.

The end of segregation and votes for black people and women – as ordinary as these outcomes can now sound – were hard-fought struggles against entrenched reaction and commercial interest which echoed around the world. The anti-apartheid movement wasn’t assured of success.

At one time the idea of most countries signing a charter urging world peace and harmony would have sounded silly – yet that is what the United Nations is (with all its shortcomings): a popular attempt at a punctuation mark on mass, mechanised death – supported, of course, by powerful lobbies and nations whose interests it served.

The Treaty of Rome in 1957 had democratic and elite support. It led to the longest period of peace in modern European history.

So positive international change happens and it can be grand in scale, even if progress is far from guaranteed and has to be fought for in order for it to benefit ordinary people rather than only the powerful. The interests of the 1% can at times be made to coalesce with those of the rest of us.

It’d be wrong to imagine that recent trends toward nationalism or insularity can only lead one way, even if further fragmentation looks likely and things can deteriorate across time or place.

At times of stress things can pivot one way or another, making it more important than ever to put ambitious ideas on to the agenda and for good people who’d otherwise do nothing to get off their backsides.

Useful change is usually the result of thoughtful people engaging in protest and democracy, with coherent political objectives: pressure from below, with an eye beyond national borders.

Back on the idealistic subject of the need to build the world back better, it’s important not to see things in binary. Globalisation will moderate and perhaps retreat, but it won’t end. It benefits large, rising powers like China, which needs the high-spending United States to buy its exports. Americans need somewhere to make their stuff, cheaply. And integration was obviously to the advantage of the United States and European corporations in recent decades.

Goods trade will probably continue to stagnate or wobble. Supply chains are shortening after Covid-19. Environmental concerns are prompting some to ask why goods need to be shipped so far.

Robots will take over some jobs from workers, so there’s less need to make products on the other side of the world. America and Europe won’t need to make so many goods in China (even if they still make a lot of things there).

But multinational companies need lower barriers to trade and investment. States usually adapt to the demands of capital.

The institutions that facilitated and accompanied the last phase of globalisation won’t just crumble. They’re needed to smooth the flow of capital and trade with rules and norms for commerce.

A small but significant chance exists that new global institutions emerge to service the changed environment, just as during previous crises. New types of global governance might centre around the digital economy where so much trade now takes place.

International digital trade is largely unregulated but some argue we’re at the start of a new era — like the age of steam, container ship or airline.

Companies (mostly big ones in the US, Europe and increasingly China) will demand protection of their intellectual property. They’ll need rules for selling their stuff to other countries, which needs legislation and common formats. The current talks on digital trade at the World Trade Organisation are among the most interesting and important.

A shift to a new, online, less labour-intensive type of globalisation might already be happening – although any shift won’t be absolute, and shoppers in the rich world will for a long time still want to take advantage of cheap labour in poor countries.

Unfortunately financial globalisation is rushing ahead. That sort of integration has boomed in recent years and doesn’t necessarily look like slowing down nor being regulated better. The world economy will remain a casino for financial market speculators.

Source: Financial Times, H/T @DanielaGabor

What’s likely is that we’re seeing the ending of one phase of international consolidation and the dawn of another. It needs to be bent toward the needs of the majority.

Build the world back better

Bike lanes are all very well, but it’s global change that really counts.

At a time when politicians and commentators are talking about the need to rebuild more sensibly after Covid-19, it’s more important than ever to think globally. Most recent health, economic and environmental crises were international, and so must be the remedies. This view isn’t misty-eyed one-worldism; it’s self-preservation.

Pandemics like Covid-19 are inherently global. The first death was reported on January 11. Ten days later the virus was being treated in half a dozen countries. The pathogen’s spread has now made it more lethal than any other in nearly a century.

The only way to tackle it successfully is to coordinate the international response, sharing information on its causes and proliferation, and collaborating on containment and vaccines.

Heading off any future potential viral outbreaks at source would be the best way of preventing more crises. The next Covid will probably come from the developing world. This means large-scale coordinated international humanitarian and development assistance in zones of potential concern — before the fact, not after.

Ebola, for instance, was a story of poverty and over-stretched West African health systems as much as it was a terrible new illness. Communities and hospitals simply couldn’t cope. The prospect of such a disease reaching the scale of Covid is even more horrifying than the original catastrophe.

Investment in vulnerable countries’ economies, national revenue collection and health systems needs to be scaled up — not only an act of caring, but a form of insurance against future disasters.

A further reason to think and act globally is that health and environmental shocks are connected. Ebola and Covid can be traced to the invasion of isolated ecosystems and to over-intensive farming techniques.

Humans are exploiting animals to unprecedented levels and intruding more and more on the habitats of previously less-contacted species. Without joined-up thinking, separate health and environmental initiatives will simply fall short of objectives.

Three out of four new infectious diseases come from animals. Covid has been linked to bats and Pangolins in East Asian meat markets.

According to the UN Environment Programme: “[The] Ebola outbreak in West Africa was the result of forest losses leading to closer contacts between wildlife and human settlements; the emergence of avian influenza was linked to intensive poultry farming; and the Nipah virus was linked to the intensification of pig farming and fruit production in Malaysia”.

It’s long been clear that global and local pressures on the environment must be addressed internationally. Just as burning and logging the Brazilian rainforest amounts to destruction of the world’s biggest carbon sink, so too, Chinese, European and US emissions in effect cause coastlines on the other side of the world to be swamped.

The largest carbon emitters can each make a difference on their own, but no single country will do so without another first committing, which is why a commonly-negotiated binding agreement is so essential.

And it’s no good folk in the rich world thinking they’ll stop domestic flooding only by recycling more or installing bike lanes. Enlightened though such moves are, global carbon cuts will have an incalculably larger benefit.

In the same way that climate breakdown blows back on the rich in the form of health and national environmental emergencies, so does global poverty itself. The main reason Europe has recently faced such large refugee inflows is that some people from poor or unstable countries understandably want to leave.

Immigrants are in reality good for the countries they arrive in, working hard in the jobs locals don’t want to do and forming a valuable source of dynamism and entrepreneurship.

But no-one wants to fester in a refugee camp. And anti-immigration sentiment is easily manipulated by short-sighted populists; arguably the biggest current scourge of the rich world.

As mercenary as it sounds, reducing poverty at source and reducing overseas conflict would make it safer and more attractive for poor people to stay at home and help them live more sustainably.

Poor communities are often the guardians of the natural environment on which the rich countries depend. The Kayapo and other Brazilian tribespeople defending their areas of the rainforest from logging and mining are in effect acting on behalf of the world. Pacific islanders who protect their seas from illegal fishing safeguard two-thirds of the earth’s surface.

Conversely poverty can lead to unsustainable exploitation of the natural environment. Deforestation and illegal mining, for example, are partly economic in origin, as people search for fuel and income. Drought and flooding also contribute to emigration.

Economic instability makes for an increasingly global undertow to health and environmental stress. Economic crises have been deepening and becoming more regular, and globalisation has synchronised the cycles of several markets, regions and countries which used to be relatively independent.

A currency wobble soon becomes a financial meltdown, and before long a worldwide economic downturn. As we’re now finding out, environmental, refugee and health problems become more acute amid growing poverty and insecurity.

Depending on how you define the term, a crisis has struck about once a year since 1990, beginning with widespread recession among developed countries, a series of national calamities, then the Asian collapse and the Russian devaluation and default toward the end of the decade.

The 2000s kicked off with the recession brought on by the bursting of the dotcom bubble – then turmoil really got going with the 2007-2009 global economic crisis and the fallout across Europe. This rocky road ended in 2020 with the worst economic crash in centuries, the impact of which will play out for many years.

New foundations

These health, environmental and economic convulsions are inherently linked. They can’t be addressed by one nation alone behind closed borders. As unlikely as it currently sounds in a fragmenting world, the only answer is common action using fit-for-purpose global rules and institutions.

A global green new deal is critical, reflating the world economy with sustainable infrastructure ready to serve people and the planet. Not only must the Paris climate targets be met, but policies put in place to reduce carbon dependency, protect ecosystems and water resources, and alleviate poverty.

UN reform is a prerequisite for such an ambitious programme, starting with full representation of all of the world’s regions on the Security Council rather than only the five powerful nations that won the second world war.

Other than China, no Asian country is a permanent member — nor any African or Latin American nation. Concerted and unified pressure from these rising regions can lead to real change.

The UN Sustainable Development Goals, worthy though they are, are now beginning to look over-ambitious, with not enough done to ensure compliance. The machinery for implementation needs to be put in place before it’s too late.

One of the most sensible ways in which the rich world could build back better would be to get its own economic house in order, ending the financial lawlessness that leads to worsening crises. This means resetting the monetary system, with coordination of global macroeconomic policy, exchange rate management and capital flows.

As part of this reset, leadership of the World Bank and International Monetary Fund – at the helm of the global economy – needs to change so that all countries are properly represented in leadership, ending the anachronism whereby Europe and the US split leadership between them.

Radical options to be re-explored include an international clearing union, world currency and global minimum wage.

Further taxing international financial transactions would throw sand in the wheels of international flows and deter speculators. This is particularly needed in the case for commodity derivatives speculation, which directly causes poverty and hardship.

Instead of the world having to bail poorer governments out so often and write off loans, it would be better to avoid the conditions that created the debt in the first place, which include forcing austerity policies on to poor or emerging countries, making them reliant on international capital markets and making it difficult for them to earn foreign exchange. The UN has even proposed a sovereign debt forum and an international mechanism for restructuring sovereign debt.

Broad-based support for the least developed countries would help head off future health and environmental ructions at source and cushion the impact on the worst off. This support needs to encompass trade, investment, commodities, technology and climate breakdown.

Some have even proposed a Marshall Plan for health, with wealthy countries clubbing together to kickstart mass investment in health infrastructure among poorer nations.

If all of this sounds ambitious, that’s because it is. The very foundations of the world are creaking, and this parlous state demands unified health, environmental and economic action. Weakness and indecision will only lead to further division, heralding yet worse calamity.

Crisis need not feed on itself. Enlightenment can spring from the darkest places. Just as the old international system emerged from the second world war, extreme stress can, against the odds, bring new beginnings.

As Lenin said, there are decades where nothing happens and weeks where decades happen. Instead of waiting for the weeks when a crumbling house turns to dust, it would be better to start rebuilding now.