The burning of the old order

A true story

A young man sits on a red couch in the lobby of Jakarta’s Marriott hotel, having just walked from his cheap digs round the corner. He’s hot and jaded after a night drinking Bir Bintang. Beige chinos and a blue cotton shirt that sticks to his back are the livery of an eager western journalist in the tropics.

A waitress pushes a trolley past wearing a white uniform, starched, like a nurse’s. He orders a glass of water and a coffee. Milk, no sugar. Muzak burbles from somewhere unknown. Simply Red or Michael Bublé? He doesn’t care; he’s more into techno. His mind is already drifting back to the impressionist blur of the bar at Tanamur and the taxi ride home.

He’s here to interview a renowned Professor of economics from Princeton University, who’s flown in a day late after getting the time zone wrong. The young man rereads the half dozen questions he’s scribbled in blue ink on an A4 sheet.

The list seems banal and makes him sound stupid. His interviewee might sneer. Will an American academic have any idea how fast the region’s economies will grow this year, the first of the new millennium? Surely he’ll pierce through the young reporter’s feigned insight.

Most of the questions are cribbed from the web. Are the World Bank and International Monetary Fund bad? Will East Asia’s lingering debts slow progress?

The young man had arrived in the region a couple of years earlier, when burning Sumatra blew smoke across the Straits of Malacca. A brown veil covered the window of his forty-second-floor office. Outside, his lungs hurt. Locals wore masks decades before they caught on in the rest of the world.

The haze, as locals called it, was caused by Indonesian farmers slashing and torching forests to plant new crops. It enveloped whole countries, seeming to mark the end of the economic boom, a time when countries leapt from the shadows.

Sometimes the haze clouded the young man’s mind.

He fidgets. He’s read the Prof’s best-seller (only later realising it was a play on the title of an 80s novel and film) and tried in vain to understand some of his academic papers. A decade earlier the Prof had won a big medal for up-and-coming economists – often a pointer to the Nobel. Like most liberals of the time, the young man hoovers up the Prof’s blogs and journalism.

As the young man shifts again in his chair an average-sized bearded man with curly dark brown hair ambles across the hotel lobby. He wears an open-necked checked shirt and a blazer. He smiles modestly.

The timid inquisitor shakes the hand of his jetlagged respondent.

Pleased to meet you-hope you had a good trip-apologies for lateness-never mind (the young man was secretly glad he could spend another evening in the bar).

“Do you think Malaysia’s capital controls were a good idea,” he blurts.

The Prof makes a sound like a surfacing whale. “Oh, not that old line again.”

“If you ask me, it was too late.”

The Prof patiently explains what capital controls are: a ban on foreigners trading Malaysia’s currency and limits or levies on how much they can bring in and out of the country.

He says tax might sound like a good way for Malaysia to stop investors from fleeing, but the worst has already passed and the rest of the region’s economies are beginning to grow again.

The IMF and the World Bank hate the capital controls, he continues, because they violate the free-market rulebook. For that reason, lefties love them.

“Will capital controls scare away foreigners in the future?”

“Probably not, because everyone’s so desperate to make money.”

“How do you see Asia’s – and the world’s – economic prospects now that the crisis has passed?”

The Prof again exhales. He says that one of the main things about the world economy in the last few decades is that the United States buys much more from abroad than it sells – $400 billion more in 1999, to be precise.

Other nations make the trinkets that rapacious US consumers crave. American manufacturing has long been dying, so more goods flow into the States than out. “More and more of our imports come from overseas,” President George Bush said that year with a straight face.

You’d expect this deficit in trade to kill demand for the US dollar, continues the Prof, but the currency stays strong because the world – and particularly newly rich Asian business owners – invest their profits in American housing and shares.

“In accounting terms…

Oof, if ever there was a phrase designed to test the attention of a sleepy interviewer. The young man’s bum suddenly hurts and he shuffles in his seat.

“… by definition if a country spends more than it earns from trade, it has to borrow or attract investment from abroad to make up the difference. The numbers are roughly equal but opposite—one’s a deficit, the other’s a surplus. The US capital account surplus, or excess of savings, is the inverse of the current account deficit.”

How this plays out in practice, continues the Prof, is that the dollar and the explosion in American financial markets feed on Asia’s rise.

Huge, booming nations like China and Indonesia offer oceans of cheap labour and resources. Asia’s upturn, based on cheap wages, act as the flipside of the US trade deficit and strong dollar.

Plus, Washington mints the world’s currency so everyone has to use it.

“Who knows how long this’ll all last? As long as it does, the world’s probably going to be OK,” says the Prof.

“But the dollar’s strength despite the trade deficit is like when the cartoon character Wiley Coyote runs off a cliff into thin air. Sooner or later he looks down and plummets to the ground.”

Later, digesting the Prof’s lesson, the young man takes a taxi to Kota port in the north of the city. The pointed prows of a hundred wooden pinisi sailing ships adorn the quay. From a distance they look like they’re for the tourists.

As he nears, he finds out that the vessels travel onwards to Sumatra carrying wood from Borneo. Painted white with a red stripe, they sport ketch rigs with ratlines running up their masts. Planks down to the quay bear sweating, barefooted men wearing sarongs, each of whom heave six hardwood beams ashore.

The young man wishes he had a better camera to capture the people; and to photo the ships, which look they’re from a Conrad novel. During half an hour at the far end of the dock he watches a dispute between three hulking, barefoot local Indonesians plastered in dust, and an Indonesian Chinese man in a smooth suit who then barks instructions down a mobile phone. The wild, angry stevedores stare down from the truck they just loaded. The slim, immaculate boss refuses to look them in the eye, and chatters.

Many locals blame the economic malaise on the ethnic Chinese, who own a lot of businesses but mostly don’t do the hard graft. Tales circulated of businessmen selling their Mercedes for a few grand at Soekarno-Hatta airport as they fled ethnic unrest.

But it wasn’t about race. The crisis was the result of hubris and the insatiable appetite of global investors for high returns. It was a regional bubble stoked by hot money flowing in from abroad and suddenly out again, fuelled by America’s thirst for stuff and blossoming Asia’s happiness to oblige – cheaply.

Those stevedores are like hundreds of millions of low-waged workers across the region who power the boom. Their bosses plough the profits into the booming US stock and property markets, propping up the dollar, whose strength boosts American buying power. The United States and Asia are the pincers of a huge crab encircling the globe.

The young man walks on toward Jakarta’s LapanganMerdeka, or independence square. Towering within is the Monas monument, known locally as Sukarno’s last erection, after the first president who was kicked out in 1967.

More and more green-uniformed policemen in riot gear carrying four-foot yellow batons. A training exercise, he wonders, in readiness for more demonstrations against the regime?

As he draws closer to Jalan Thamrin he comes across students chanting “save Aceh” in English.

The students, numbering around 200 and from Jakarta’s Muhammadiyah University, wear headbands bearing the slogan “Aksi Peduli Aceh,” or Aceh Solidarity Action. A police battalion skulks awkwardly at a distance, flowers adorning guns. Gudung Garam cigarettes lace the air with cloves.

A powerful woman wearing a green tudong bellows slogans down a megaphone in front of the sitting demonstrators. She punches the air with her fist, inviting the others to follow. The young man thinks his protests against student grant cuts in London were trivial.

Someone gives him an orchid, and a badge with a black ribbon which he ties to his rucksack. He chats with one of the organisers, Irwan, who tells him that the demonstrators are protesting against army oppression in Aceh, the northernmost Sumatran province long ruled by Java but with a long and fierce history of independence.

Irwan says he disagrees with a new proposal that the army should automatically have seats in parliament. “The army chief should step down,” he says.

The police say the protest must end at 4 o’clock. Irwan says they will leave to avoid a confrontation. He doesn’t blame the cops. What’s important is “the system”. He says that what matters is improving democracy and helping workers.

Students like him are the product of Asia’s prosperity. Their education and new freedoms prompt them to question the old regime. It’s only a couple of years since the overthrow of dictator Suharto, and a nation is being rebuilt.

Irwan and his friends will again grace independence square.

A year later the young man retired his blue cotton shirt and beige chinos, returning to university to study more economics. He’d been too shy to hunt down big scoops, and his editors didn’t want him to peer through the haze. They were only interested in what was good for American business.

In Singapore, he wasn’t allowed to touch politics in case the censorious regime kicked his magazine out of the country. The story was all about the city-state’s prowess in science, a sparkling new trade deal and how the buses ran on time: Singapore-lah.

An article he wrote about Aceh had to be about how activists used the Internet rather than why people wanted to break with Jakarta after decades of violent oppression. And anyway in the end it was the sea, not politics, that killed the dream of independence. The Indian ocean Tsunami in 2004 swallowed up some of the Acehnese campaigners he interviewed in the province, along with nearly a quarter of a million other people.

The Prof won his Nobel prize. A quarter of a century later he quit his newspaper column so that he could rail more freely against US president Donald Trump on his blogs. He’d become a kind of thought-haven for right-minded American liberals.

He described the US president variously as a virus infecting American capitalism; a cancer that grew in the dark; and like Mao’s cultural revolution – an attack on democracy and intellectual inquiry.

Wiley Coyote seemed to hang in the air, as the chasm beneath him, the US trade deficit, more than doubled to a trillion dollars. The world kept ploughing money into American shares and property, driving an explosion in wealth and inequality as the pay of US blue-collar workers stagnated while investments in housing and shares rocketed. By 2025 the richest top tenth owned nearly three-quarters of household wealth and about nine-tenths of the stock market.

The profits from work outsourced to Asia were recycled so hard into American assets like houses, that the annual salaries of Gen-Z now bought less than a fifth of a house, compared with half for a Boomer in the 1950s.

The average Gen Z blue-collar worker in the Midwest was now worse off than their grandparents. Pay lay in the gutter. Such generational decline was a first in the country’s young history.

Any doubts about Asia’s economies recovering from the crisis were immediately dispelled as they started racing again, led by China.

There, factories tripled their output in the next decade, outpacing all other major economies. When the young man lived in Asia, China made about 6% of the world’s stuff. By 2025, a third of everything was made there. Add in Asia and the share grew to more than a half. The idea that the region might sputter and fade was, in retrospect, ridiculous.

Those Jakarta stevedores may not have been on the factory floor, but they were part of the often invisible, hard-working and low-paid regional working class that fuelled these emerging nations and supplied the world’s goods.

The wood that built things; the people who carried the wood; the ships that transported them; the coal, oil, copper, and nickel; the factory workers on subsistence wages—they built the new millennium. They had more in common with their rustbelt brethren than they knew.

The global financiers who profited from this feature, and the politicians they funded, would wheedle resources and cheap labour from wherever they could for as long as possible. Americans seemed hard-wired to consume. The US would never return to some golden age of middle-class prosperity where the international trading ledger balanced.

Yet Trump campaigned on the impossible promise to eliminate the trade deficit. In all his idiocy, and without being able to articulate it, he was preying on the anger at the global system; the inequality that arose from wage stagnation and the boom in asset and house prices.

In his dim, animalistic way, the president knew that this global lop-sidedness was the cause of his voters’ problems. His solution – balancing the trade account via tariffs – was blunt and stupid, and he kept changing his mind.

But he and his advisors were in effect responding to the Prof’s lesson from back in the year 2000, that a country has to borrow or attract investment from abroad to make up the difference. To cut the trade deficit, Trump and co now wanted to stem the tide of investment flowing inwards.

Paradoxically it was the United States, not wayward Malaysia, that now proposed controls on capital. Trump in 2025 proposed tightening investment rules, making it harder for supposed adversaries like China to invest in sensitive American sectors like tech and land. He proposed taxing foreign investors whose governments purportedly acted unfairly against the US. Some of Trump’s advisers even floated the idea of charging foreigners to buy US bonds.

So it was paradoxically the US that ended up scrapping the free-market rulebook, not Asia.

The young man came to realise later that the Prof., a savant who mixed metaphors and so hated Trump, missed the point. The cheap Asian labour and resources that fed the global boom, and the American appetite for more goods than it made, weren’t aberrations that debased the economy; they were a feature. It was how the global economy worked. There was no cliff, and no Wiley.

Trump wasn’t a virus, a cancer, or Mao. He was a response to a decades-old feature of the global economy that enriched the rich and trampled the have-nots. Wishing for a return to some mythical normality wouldn’t help. Populists – Trump or otherwise – would keeping stoking the discontent and benefitting from it.

The young man, not so young or eager now, occasionally thinks back to his time in Asia. He’s still into techno and occasionally goes to bars – though less often. He sometimes reluctantly labours under the label of economist, and spends too much of his time thinking, rethinking, and wondering how far the smoke will spread.

Slaying the global Minotaur

A new Substack post about former Greek Finance Minister Yanis Varoufakis’s idea of the Global Minotaur, whereby the United States imports goods from China and northern Europe, and in return China invests the earnings in American finance and property.

I think the idea of a supposed race between two great nations might be overdone, and that the interests of China and the US are linked in such a way that there won’t soon be “a confrontation with China that casts doubt on our species’ long-term prospects” as Varoufakis says.

Theseus Fighting the Minotaur , model n.d., cast 1857/1873, Antoine-Louis Barye, US National Gallery of Art, Washington D.C.

Stop doing stupid stuff

Unpredictability and instability are worse than tariffs

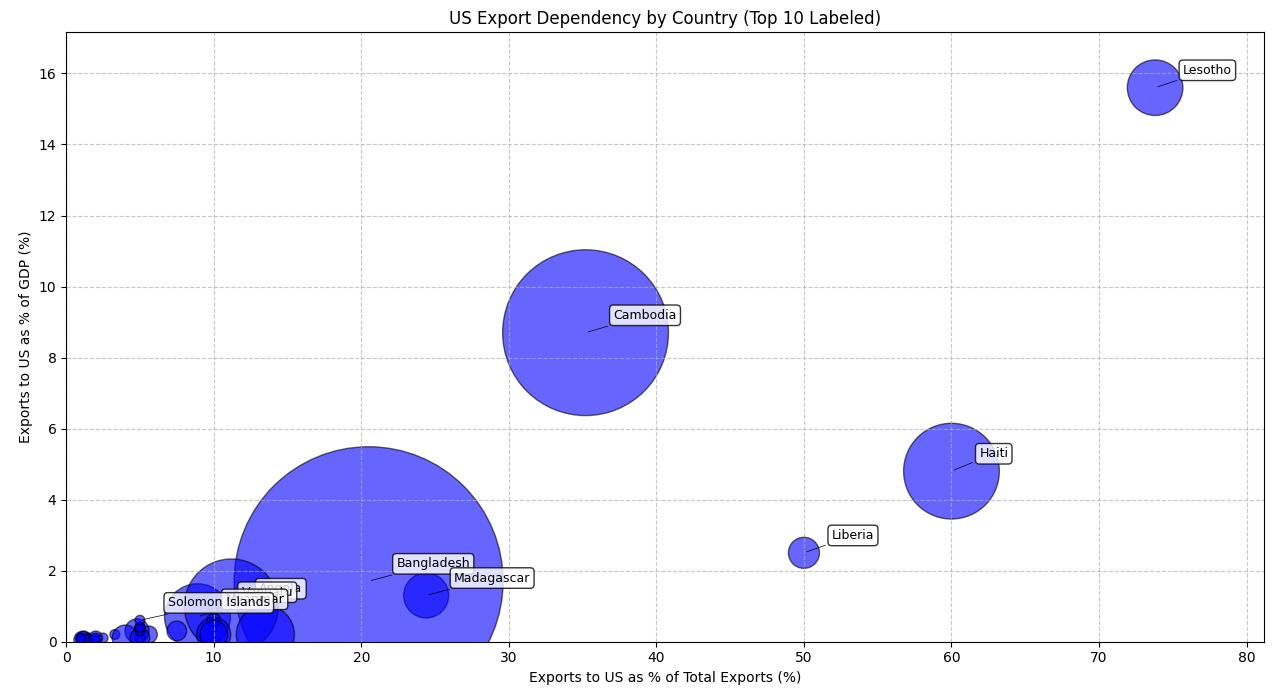

US tariffs will still hit several of the least developed countries hard, despite the US reducing them to 10%.

Lesotho, where the original tariff would have been 50%, experiences the biggest reprieve, but its exporters will still face headwinds.

Of the LDCs, Lesotho is the most exposed to US exports. Nearly three-quarters of its exports go to the US, amounting to 16% of its GDP.

The economic damage before the high tariff would’ve been high — at an estimated tenth of GDP. Now, the the impact could amount to a couple of percentage points of GDP.

This will still mean job losses or furlough, higher poverty, and further instability for a struggling economy. It’s wrong to imagine that the threat has receded.

Haiti and Cambodia, too, remain exposed. Although a relatively small proportion of Haiti’s economy is reliant on US exports (about 5%), its total export basket is heavily US-dependent.

Cambodia is more reliant on the US but its exports more geographically diversified (mainly toward Europe). Bangladesh’s total exports are the highest of any LDC (shown by the size of the bubble in the diagram below) but its reliance on the US is lower, at only about 2% of GDP.

The following diagram shows that tariffs will continue to affect the LDCs most exposed to the US.

But it’s the policy unpredictability that’s the worst. Effectively the US has thrown the African Growth and Opportunities Act (AGOA) into question, ending the situation whereby African goods faced duty-free entry into the US. Renewal already looked unlikely.

AGOA’s vulnerability to non-renewal was always its Achilles heel relative to the European Everything But Arms (EBA) initiative, which was written into law in 2001 and remained less likely to be rescinded. AGOA’s demise means that some trade will be diverted toward Europe.

Everyone knows businesses hate uncertainty — why would you expand your US-export orientated investment in Lesotho now, when Trump might change his mind next week? Few existing or potential investors anywhere, never mind in the LDCs, will see the US as a source of stability.

And the effect of the tariffs on the US economy is the biggest source of uncertainty. Never mind a 10% tariff, a US — or global — recession is a much scarier proposition. Lower growth in the world’s economic engine will have the biggest effect on LDCs as all economies lose out.

US consumers are already cutting back. Treasury bond yields have spiked (which forced Trump’s about-face). The dollar is in decline, further reducing US buying power. As stagflation beckons, few should look to the US for support.

As in previous crises, clumsy and short-termist mismanagement by the world’s biggest economies and the global financial institutions that they control are the worst problems for the LDCs.

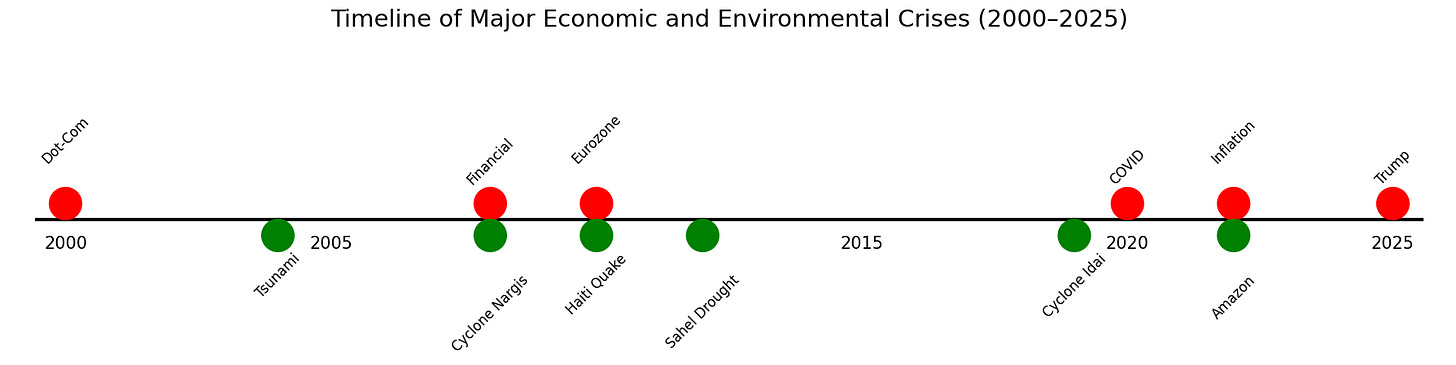

A quarter century of crisis

At least a dozen major environmental and economic crises have whacked the LDCs in the last quarter-century, often at the same time, starting with the dotcom crash in 2000. The Indian ocean Tsunami was in 2005. Then came the devastation of the global financial crisis in 2008. Cyclone Nargis the same year was the worst natural disaster in the history of Myanmar.

Many other environmental or weather-related events severely affected smaller countries – like the Western Pacific’s cyclone Pam in 2015, which chopped off half of Vanuatu’s GDP in a year.

The eurozone calamity from 2009-10 hit commodity and tourism demand worldwide — with a major fallout for LDCs. An earthquake struck Haiti. The drought in the Sahel followed, then the big three: Covid-19, inflation and now Trump.

Of course earthquakes and tsunamis aren’t human-made, but most of the others are, and they’re the result of mismanagement — either economic or environmental.

Global heating is perhaps the ultimate act of foot-shooting. It’s generated by the rich world and it’s hitting the poorest the most. Small, poorer countries have fewer resources to cope with the impact of crises. Infrastructure is more fragile. Losing a job can mean starvation. No safety nets exist.

So Trump’s tariffs aren’t only a self-inflicted wound. They’re a blow inflicted on the world’s most vulnerable. And just as many of the crises of the past quarter century could have been avoided or ameliorated, this latest bout of policy stupidity wasn’t inevitable.

I’ve long thought that we don’t need to get too clever in our theories about how to improve the relationship between the rich and poor countries (or core and periphery, developed and developing, or North and South — whichever couplet the theory demands).

No, one of the first and most achievable things would be for the rich world to stop doing supposedly self-interested but ill-considered things which have a disproportionate impact on the world’s poorest. Part of the fate of the LDCs is in the hands of rich-world policymakers. Stop doing stupid things.

Original Substack post here.

Attacking the world’s poor

The US tariffs unveiled on Wednesday will hit all 44 of the world’s least developed countries (LDCs), in some cases slashing economic growth and lowering employment — with a potentially serious impact on livelihoods.

From 9 April, 31 of these countries will face a tariff rate of 10%, while in the remaining 13 rates range from 11% in Democratic Republic of the Congo, to 50% in Lesotho.

For some countries, the shock will be severe. The affected African exporters will move from zero duties under the African Growth and Opportunity Act (AGOA), to high rates. Several of these countries depend heavily on access to the US market.

Other LDCs, like Bangladesh and Cambodia, will shift from special LDC concessionary levies at or near zero, to much higher rates — 37% in Bangladesh and 49% for Cambodia.

This big new tax on every Cambodian or Bangladeshi T-shirt crossing the US border will dramatically increase costs and put those industries under strain.

The move represents a major break from the last two decades, when LDCs were given duty-free, quota free access to many major markets, including the US, as part of a concerted international push to integrate the world’s least-advantaged nations into the global economy.

These efforts met with mixed success, but now, just as these these mostly small, poor countries are struggling to recover from the catastrophe of Covid-19 and the supply-chain and inflation crisis, they’re being pushed down even further. Never mind kicking away the ladder; it’s a case of holding their heads under water.

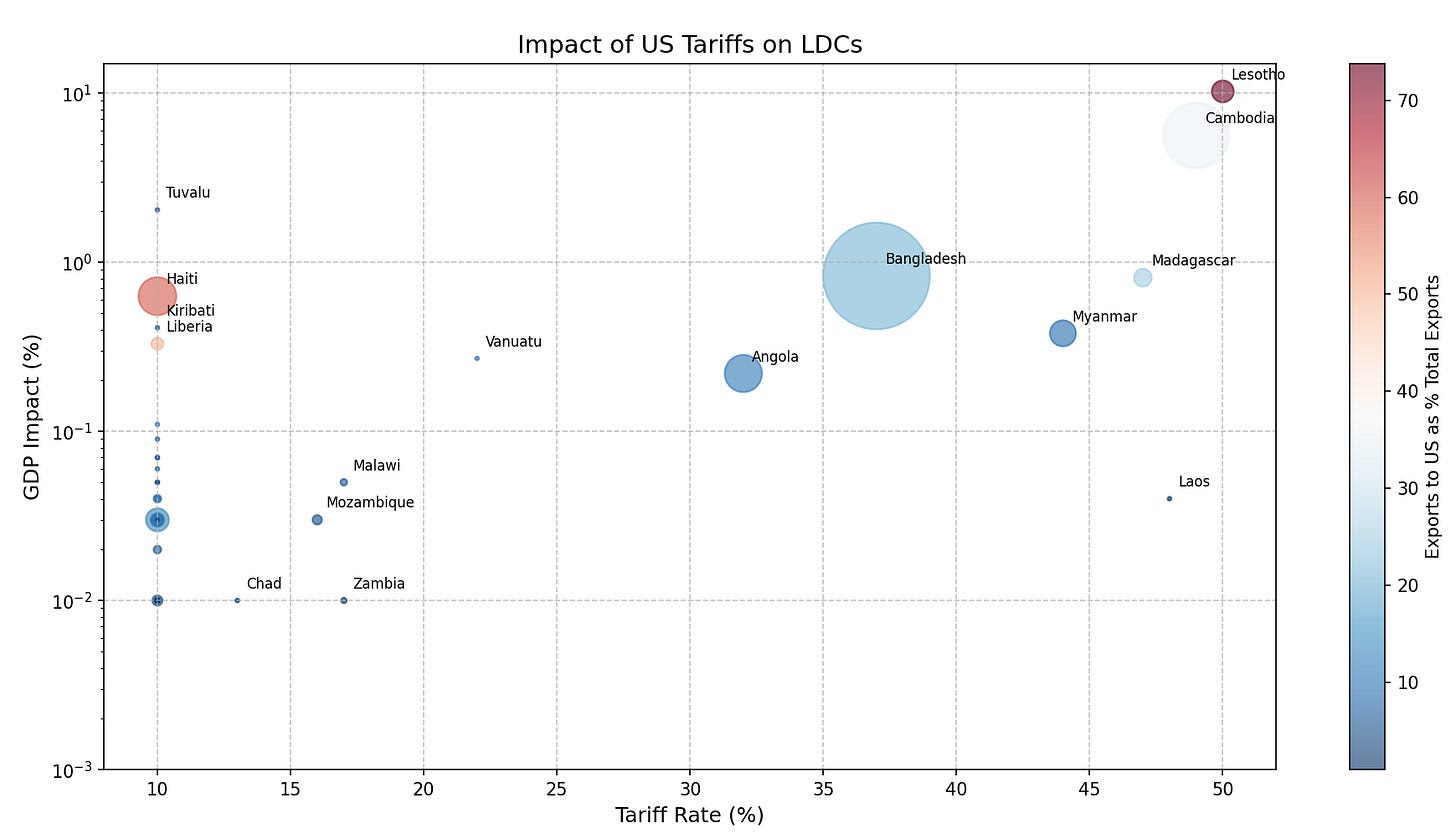

My initial calculations on the possible impacts are shown in the following figure.

Data source: OEC

Notes for nerds: The y-axis is the log of the estimated impact on GDP, in percentage terms. The x-axis is the % tariff rate faced by each LDC. The size of each bubble represents the log of total exports to the US, while the colour, from blue to red, signifies the proportion of the country’s exports going to the US.

In the basic model used to make the calculations, I assume an elasticity of -0.75 for garments. Studies suggest that a 1% price increase reduces apparel demand by 0.5% to 1% (an elasticity of -0.5 to -1). So assuming a elasticity of of -0.75, half way between these levels, a 50% price increase could reduce demand in Lesotho by 37.5% (0.75 × 50%), a loss of $120 million. Garments are easily substitutable, so this seems plausible. For commodity exporters like Angola and DR Congo I assume a lower elasticity of -0.4. I also assume that the impact of reduced spending on each economy multiplies the impact by 1.5 to 2.

Clearly this is a very basic model put together quickly that hasn’t been academically reviewed, and doubtless has shortcomings. But it serves as a rough guide as to which countries will be affected worst, together with the magnitudes.

Lesotho will suffer worst, given the dependence of the economy on exports to the US, mostly garments. Lesotho’s $2.05 billion economy sends approximately $320 million in garments to the US, or three quarters of all exports, manufactured in zones near the capital Maseru, which are run by Chinese and Taiwanese investors.

About 36,000 people work in these factories, which provide much-needed employment in a country where the poverty rate tops half of all people. This is a poor and vulnerable country which desperately needs all the help it can get. For example when I last visited about a dozen years ago, average life expectancy was only 47. Now, it’s risen, but to only 53, one of the lowest levels in the world.

The overall impact on Lesotho’s GDP could be as high as 10%. Of course manufacturers might switch some production elsewhere, but supply chains are most likely carefully designed to meet the exact demand of US consumers, and new markets won’t easily be found, especially when other garment exporters are facing the same situation.

Instead of cutting jobs, employers might try to furlough workers or pay them less — although neither of these options would be good. It’s quite possible that investors will simply shut up shup and move elsewhere. The industry is surprisingly footloose, with relatively low capital outlays and basic skill levels.

Because of the poor design of the tariffs and the fact that they’re somewhat arbitrary, some countries may just shift production to a low tariff neighbour and carry on as usual. Might an African neighbour benefit? Trump doesn’t seem to know about rules of origin. Either way, the impact could be disastrous.

Cambodia is also going to get hammered unless something changes. About 35% of its exports, also mostly garments, go to the US. That’s about 8.7% of GDP. My basic calculations suggest that the impact on GDP could be as much as 5% — not as bad as Lesotho but still highly destabilising in a poor country with limited opportunity for diversification and facing fierce competition.

Madagascar’s vanilla exporters are also likely to suffer. About a quarter of the country’s exports go to the US and it faces a 47% tariff.

Laos, Bangladesh, Myanmar and Angola equally face a potentially severe impact. All either meet the criteria to graduate from the LDC category or are imminently scheduled to do so. The US tariffs will set back their cause.

Bangladesh is the world’s second-largest garment exporter and the industry has propelled the country to high rates of economic growth in recent years, leading to poverty reduction of as much as 50 million.

Against the backdrop of the country’s recent regime change, the huge garment industry needs to be supported, not undermined. Although Bangladesh didn’t benefit significantly from the US duty-free, quota-free scheme, the 20% of exports that go to the US cannot quickly switch to Europe.

During my visits to Dhaka, business leaders told me they could cope with the few percentage points tariff increase that may come through LDC graduation, but presumably not 37%. It will be workers who pay, not factory owners.

Over 3000 people have died in Myanmar following the earthquake last Friday. However poisonous the regime, slapping the country with a 44% tariff at this time seems positively cruel. European investors told me when I went to Naypyidaw and Yangon before the 2021 coup that the country was already barely competitive in garments, and risked losing business to more stable and cheaper Asian neighbours.

The same goes for Haiti. 60% of its exports — again garments — go to the US. The country is reported as being essentially ungovernable, with gangs controlling large parts of the capital, Port-au-Prince and the economy in freefall.

Although the US tariff is ‘only’ 10%, it’ll still have an impact on an already desperate situation, given the volumes involved, the dire need for jobs and the undiversified nature of the economy.

I worked in Haiti during Hurricane Sandy in 2012, and only on a few occasions have I been amidst such destruction, and seen such hopelessness. Things have got worse since then. Inflicting more pain on a country where nearly 60% live below the poverty line seems simply abusive.

A devastating failure

Most LDCs will escape any major impact because they don’t export much to US, total exports were minimal, or the proposed tariff is low — or some combination of the three. Several didn’t benefit much from the US duty-free scheme anyway.

Some LDCs might be able to switch export to other markets. Doubtless China will swoop in to buy more from the commodity producers. The EU is already preparing to receive a flood of goods previously destined for the US market but which will now be diverted.

But overall, in the eight or more counties where the tariffs will have a major impact, jobs at risk could total as many as 380,000 — mostly in Bangladesh and Cambodia, but also elsewhere. Any job in an LDC is a hard-won prize, and replacing lost employment is often much harder than in richer, more diversified countries.

The loss of export revenues could reach as much as a quarter of the total from LDCs unless something changes.

For Lesotho and Myanmar the potential economic impact will be severe and possibly even unmanageable. LDCs don’t have unemployment benefits and most people have no or minimal savings. And this is on top of US aid cuts, which are already biting hard.

What’s horribly ironic is that the tariffs on these countries won’t even benefit the US, which isn’t quickly going to bring back garment production — nor should it want to. US workers won’t graft for six days a week making T-shirts for $100 a month, as Bangladeshis do.

The US can’t even produce some of the things it’s supposedly ‘protecting’. Good luck growing bananas or coffee. The tariffs will mean higher costs for US businesses and consumers.

And the collective trade surplus of the LDCs with the US amounts to only 0.001% of the US trade deficit, so will make absolutely no difference to Trump’s stated (stupid) aim of ‘balanced’ trade — not that tariffs will do so anyway.

In sum, these half-baked and poorly-thought-out tariffs, which will raise rates to the highest in over a century, will not only fail, but will needlessly inflict yet more pain on populations that were already suffering from severe poverty and deprivation.

As i’ve said elsewhere, the oligarchs currently mismanaging the US economy don’t care. They view ordinary people as expendable, and any unintended consequences arising from their blunders as meaningless collateral damage. The latest moves amount to nothing other than an attack on the world’s poor.

The end of multilateralism?

New Substack on how globalisation is running on full batteries despite US unilateralism and insularity. Globalisation is less and less about international trade in goods and more about intangible trade, particularly digitally-deliverable services. The free movement of capital is flourishing.

The post is here.

As you might have noticed i’ve been putting all new posts on Substack. Please consider subscribing. My latest piece is here: The Musk slips.

New post on Substack, The Blindness of the Comfortable, about how apathy in the face of atrocity makes you complicit. Far right support for the genocide in Gaza betrays a contempt for humanity.

Link here.

New post on the importance of economics in explaining the current state of politics.