The economics spring

For economics nerds like me the last week has been riveting. Paul Krugman, a Nobel-prizewinning member of the economics establishment, has been debating with Steve Keen, a radical who’s long argued that the conventional economics taught in universities is woefully unrealistic because it ignores important features of the real world like uncertainty, the role of banks, debt and how money is created.

I may be wrong, but it looks like a tipping point. A host of concerned economy-watchers are beginning to understand that most economists failed to understand or predict the global economic crisis, and should therefore be deposed. Just as the despots of north Africa and the middle East crumbled in the face of a critical mass of popular opposition, so too mainstream economics is looking shaky in the fresh-faced glare of laymen.

For an arcane debate about the role of money, it’s surprising how fast the Keen-Krugman debate has shot round the blogosphere. Like in the Arab spring, social media have played a critical part in exposing mainstream economics for the bullshit that it is.

The debate’s even broken through to the cable channels. Russia’s RT yesterday gave free rein to Keen in a five-minute interview. The FT’s Alphaville reposted the BBC interview with Keen last November, attracting a host of sympathetic comments.

For anyone who doesn’t lurk on the fringes of economics, I can’t overstate just how remarkable this situation is. I remember buying Keen’s book, Debunking Economics: The Naked Emperor of the Social Sciences whilst studying for my mainstream MSc in economics in 2002. The book seemed like one of those sensible bits of radicalism that would, alas, never receive a popular airing. So far was it from received wisdom that no lecturer or journalist would acknowledge it, still less actually read it.

Frustrated, I wrote a rant about economics, published here. It seemed to me that mainstream economics had fallen so in love with its mathematical tools, contrived in ivory towers, that it’d forgotten to look outside the window. Not much of what I studied seemed to reflect what i’d actually seen as a practising political economist in the real world.

When writing about the Asian crisis which began in 1997 i’d found that no, financial markets didn’t always tend toward equilibrium — and yet this was a central plank of conventional analysis, if not the main assumption. As Keen rightly says:

if it isn’t disequilbrium, then it isn’t economics…“disequilibrium” is so common in real sciences that they don’t even call it that: they call it dynamics. Any dynamic model of a process must start away from its equilibrium, because if you start it in its equilibrium, nothing happens. It’s about time that economists woke up to the need to model the economy dynamically.

After interviewing scores of financial analysts i’d understood that the efficient markets hypothesis — which predicted that financial market prices always reflected all available information — had to be untrue, because otherwise there’d be no point in doing any analysis.

Later, when I worked in developing countries i’d seen that homo economicus, the rational, self-interested utility maximiser, was a fiction dreamt up by a peculiar brand of academic who appeared never to have actually dirtied his hands by interacting with real people. The assumptions of some economic models sound like a joke, but their outcomes aren’t so funny because they influence policy.

Some modellers (i’m serious) pretend that the economy consists of two consumers and two producers acting with perfect foresight, rationality and certainty — forever. Krugman, the object of Keen’s derision, argues that unrealistic assumptions are useful because they allow us to boil down models to a highly simplified version of the world that reflects only the essential dynamics necessary. We all use unrealistic models in everyday life, Krugman says, and economics just formalises this ordinary way of thinking.

Yes, but there’s a vast gulf between everyday rules of thumb and the mathematical models of the academy. Many models are so tightly specified and so unrealistic that they have very little bearing on the real world. You might well start with the assumption that, say, people have perfect foresight, and then relax that assumption later. But why bother, when people don’t have perfect foresight? Why not start from the realistic view that people are pretty poor at knowing the future?

So the crisis in economics isn’t just some obscure spat between balding professors; it’s a crucial and deep-seated methodological conflict that goes to the heart of how we theorise about society and the economy. And because it’s economics, which affects things like how much people have to eat and how hard we work, it’s much more important than your normal academic showdown.

As Keen says, one of the reasons why he is suddenly in the public glare is that mainstream models didn’t predict the crisis, so we can ignore them. In the RT video he says that people are realising that, “we can’t leave economics to the economists”. Here’s another good quote: “Maybe we can break down the neoclassical citadel from the outside with the help of the public.”

Lots of mainstream economists for the first time discovered Keen’s hero, Hyman Minsky, in late 2007, calling it a ‘Minsky moment’. But Minsky has widely been misunderstood.

To vastly oversimplify, Keen (drawing on Minsky) is essentially saying the following:

According to conventional views of the financial sector, banks take money from depositors, charge a small amount of interest, and lend it on to businesses and individuals. But in Keen’s Minskyan view, this conventional picture is precisely the wrong way round. Banks actually create money rather than just being neutral intermediaries between savers and borrowers.

Banks don’t have to rely on their cash reserves; they can lend money without bothering about the actual amount of money they’ve taken in from you and me. That delay when a cash machine is whirring isn’t it referring to head office to see how much the bank can afford. People and companies can (and did, during the build-up to the crisis) run up massive overdrafts, well in excess of what they actually earn. So investment leads to savings, rather than savings creating investment. Banks aren’t just passive bystanders — they literally make money. This view is supported by a host of independent-minded central bankers, many of who have revised their views in the wake of the crisis.

This leads to the second main point: that economic output is made up of income and debt, and that debt is in turn is comprised of both good debt which is used to invest in new, useful things and bad, ponzi debt that goes on existing assets [update: Michael Hoexter makes the important point in the comments that this sort of debt is also spent on speculation]. (Some borrowing can be spent on consumption as well).

Much of the last decade or more of economic growth in the rich world was based on hot air. Debt was being spent on property, shares and bonds, creating fake wealth and further inflating the economy. Credit cards were flung at consumers with abandon. Interest rates at historic lows fuelled this vacuous economic growth, effectively creating free money. It’s even worse than that — the 2-3% interest rates currently charged for UK mortgages are below inflation, which means that home-owners are effectively being paid to borrow.

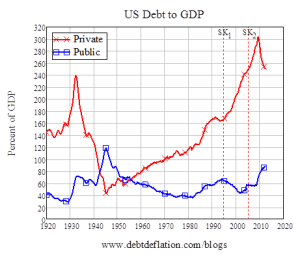

Amazingly, mainstream economists don’t see a role for debt. Krugman’s seminal article for the New York Times, How Did Economists Get it so Wrong? never mentions private debt. Yet private debt was clearly completely central to the crisis, as shown by the following diagrams.

There’s also a bit of ideology at work here. The main political parties have all subscribed to the notion that the government spent too much and that we have to pay the public debt down. Clearly this view plays well to those who argue that governments should always be small. But the top graph shows that after the second world war US private debt gradually climbed to its highest level in over a century, its peak coinciding with the crisis. The solution to the crisis will involve private deleveraging, a process which is already beginning.

If you look at the bottom graph, UK financial companies are by far the worst culprits. Their debt exploded in the last two decades to about four-and-a-half times the annual output of the economy, whilst household and non-financial debt rose by a smaller proportion — each roughly doubling over the same period compared with GDP.

As a matter of fact, public debt isn’t at historic highs, and at least in the UK and the US borrowing costs are so low that the government doesn’t have to pay much to service this debt.

Krugman’s final answer to Keen is revealing. He resorts to wilful mischaracterisation of Keen’s point of view, pretending that Keen doesn’t understand basic new Keynesian views about sticky prices and wage rigidities. It’s a dishonest and dismissive tactic which shows Krugman’s unwillingness to challenge his own basic conceptions, not to mention the extent to which he is wedded to an outdated version of economics. Can’t he actually engage with his opponent’s view, rather than attacking a caricature of it?

Maybe the mainstream is out of ideas, and it can’t come up with genuine challenges to the new alternatives proposed by people like Keen? Maybe this is the real Minsky moment?

Next week it’s the third annual conference of the Institute for New Economic Thinking in Berlin, where Keen will be speaking. It’ll be interesting to see what he has to say.

Great summary to the debate! I would add or amend a few paragraphs from the end that “bad” ponzi debt is not simply used to buy assets but to speculate on the price of assets: to “flip” stocks and real estate rather than invest in the long term. In a reformed lending system, people will continue to need to buy assets with debt when they use the assets’ useful output or “services” for their own productive or personal uses. Keen’s reform proposals address these distinctions; http://www.debtdeflation.com/blogs/2012/01/03/the-debtwatch-manifesto/

Thanks Michael, yes, you’re right. I should have made that clearer. The speculation and flipping role is key, and it’s important not to write off the idea of debt completely. Of course people will still need debt for real things. Keen is clear on the idea that debt is often useful.

I’d like to see Keen utilize the tactic of “immanent criticism” to expose the Big Lie that undergirds mainstream economics/models :

“And what is immanent criticism? In brief, it is the following: You take the establishment theory, the dominant paradigm, and you refrain from criticising its basic presumptions. What you do is to show that, by its own criteria, on the basis of its own assumptions, the model (or theory) which the Establishment accepts as valid, produces ‘subversive’ results. Nothing upsets the Establishment more than to have something like this demonstrated; that its ‘favourite’ theory recommends views and policies which are detrimental to the Establishment’s own ideology.”

( From a Yanis Varoufakis essay , here : http://yanisvaroufakis.eu/2012/04/04/on-keynes-marx-and-the-value-of-models-at-a-time-of-crisis-a-reply-to-david-laibman/ )

Not only does that sound like it would be more effective , it sounds like more fun , too!

Just want to add for the sake of real worldness, that Gov debt might not have been at historic highs but deficits certainly were, and in the real world, if they remained at those highs that required the UK government to borrow 20B+ a month to close the gap then problems would definitely accrue, or at least the risks of future problems would accrue. Also rating agencies say hi.

It may be be ideological to focus on public debt, but to try and then pull a 360 and sweep the problems of deficits under the carpet is ideological also, Lets not create false dichotomies.

Yup, the UK deficit, like many others, is certainly pretty awful and needs to be sorted out — i’m sure Keen would acknowledge this. The only choice is between cut now or cut later. But that debate’s been played out a thousand times elsewhere and it’s not really the focus of the current discussion. What is true is that most of the media fail to distinguish between private debt — which is much bigger and has grown faster — and public debt, which is still very high but not as high as private. There also isn’t much discussion of the way in which some private debt has been socialised, and the links between the two.

Agree fully with all you say. Actually mainstream economist are contradicting Krugman in numbers, just read latest report by BIS/Committee of Global Financial System: Global liquidity – concept, measurement and policy implications, CGFS Publications No 45 where they talk a lot about “endogenous finance”.

I have written extensively about this and excessive private credit growth and how central banks should react in this new Levy Institute WP on shadow banking and central bank liquidity support.

http://www.levyinstitute.org/publications/?docid=1513