The non-economics of Desperate Dave

David Cameron today again repeated the nonsense claim that anything other than swingeing cuts will cause “economic chaos”. In an indication of just how impoverished mainstream British political debate has become, he lambasted Labour’s plans to balance the budget but keep spending on infrastructure as if it were Zimbabwe-esque profligacy.

Yet far from lowering the deficit, the cuts are one reason why the economy has suffered its worst period of growth since the Great Depression in the 1930s. Balancing the budget is exactly the wrong medicine in a crisis. The coalition has sucked so much money out of the economy that demand and investment have collapsed, raising welfare payments and reducing tax revenues.

The mainstream media’s fixation with the last five-minute’s news means that they tend to focus on headline economic growth, which recently hit a quarterly rate of 0.7%. But the economy shrank so much after the crisis hit in 2008 that it was likely to rebound sooner or later. Because of population growth, it’s still smaller per head than before the crisis.

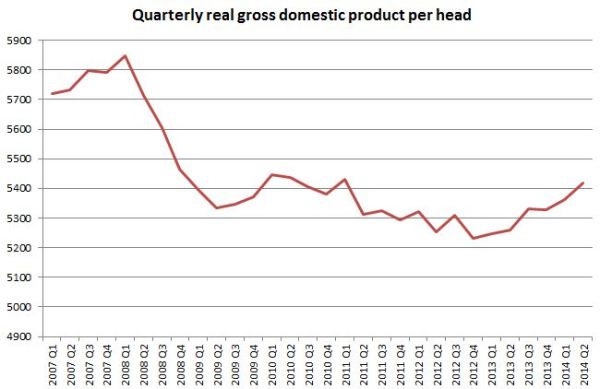

Here’s a graph Cameron doesn’t want you to see:

Data source: Office for National Statistics

Taking inflation into account economic output is now 7.3% smaller per head than at the start of the crisis in the first quarter of 2008. We’ve only now climbed back to the levels of about 2005. Of course averages don’t tell the whole story, and a small minority have become much wealthier whilst most people have suffered much more, but of the G7 group of rich countries Britain’s economy has performed second-worst, ahead of only Italy.

Alongside slowing global growth part of the reason for this economic catastrophe – the worst for 80 years – is that the government has extracted tens of billions of pounds from the economy. These sort of cuts are economically counterproductive during a recession.

The recent fall in unemployment to a still-unacceptable 6% has been the result of an increase in part-time, badly-paid and insecure work. People aren’t being paid enough to contribute to government coffers.

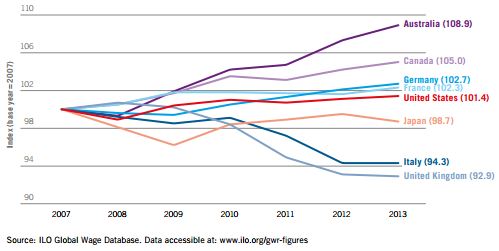

The fall in pay is a remarkable feature of the crisis. Again, accounting for inflation, the wages of a British worker have suffered their longest sustained fall since records began in 1862. The International Labour Organisation says that British pay has plunged more than even in Italy. In the five best performing countries shown in the following graph, wages have gone up.

Average real wage index for developed G20 countries, 2007-13

Because we’ve got less pay in our pockets, less money is spent than it otherwise might be, which in turn suppresses growth. Consumer expenditure collapsed during the crisis and is only just recovering. Business investment has shrunk to unprecedented levels as too few people can afford to buy companies’ products and services, and companies remain uncertain about the future. Productivity remains abysmal. I suspect that a fragile recovery based on the services sector and badly-paid jobs will peter out as the underlying economic conditions remain so bleak.

Instead of the debt falling due to government spending cuts, it’s forecast to keep going up until next year because the economy is doing worse than it otherwise would. In fact public debt isn’t particularly high by historical standards and it’s not the main problem, especially when borrowing costs are at such historic lows.

What the Tories fail to mention is that it was private debt which caused the crisis, not government debt. Private debt, mostly financial sector and corporate, grew to four-and-a-half times GDP, compared with public debt which is now 80.4% of GDP.

The deficit has ‘only’ halved as a proportion of GDP since the coalition took power, to £91.3 billion, despite Osborne’s promise to eliminate it by now. This failure is because of the cuts.

There’s more madness to come. Osborne said in his autumn statement that over the next five years he wants to shrink public spending to levels not seen since before the second world war. £60 billion will come from public service cuts. That’s nearly twice the defence budget or the equivalent of dualling Scotland’s A9 road from Perth to Inverness 143 times. Schools, health and foreign aid are ring-fenced, so some departments will be ransacked. This amounts to a full-scale attack on the state.

What we should be doing – and what Scotland could do given full economic powers – is reinflating the economy. Building infrastructure would encourage businesses to invest. Tackling the housing shortage would stimulate demand. We could develop a modern, strategic industrial policy which built a new, environmentally-sustainable economy based on Scotland’s advantages in sustainable energy. This investment would eventually pay for itself, particularly when borrowing is as cheap as it’s ever been.

Osborne and Cameron have taken us so far down the rabbit hole that we’ve confused up with down, good with bad. We should be rebuilding the economy rather than trashing it; looking after each other instead of accepting the cuts. All that rhetoric about hairshirts and tightening our belts is nonsense. We’re being punished when punishment isn’t the answer.

Trackbacks